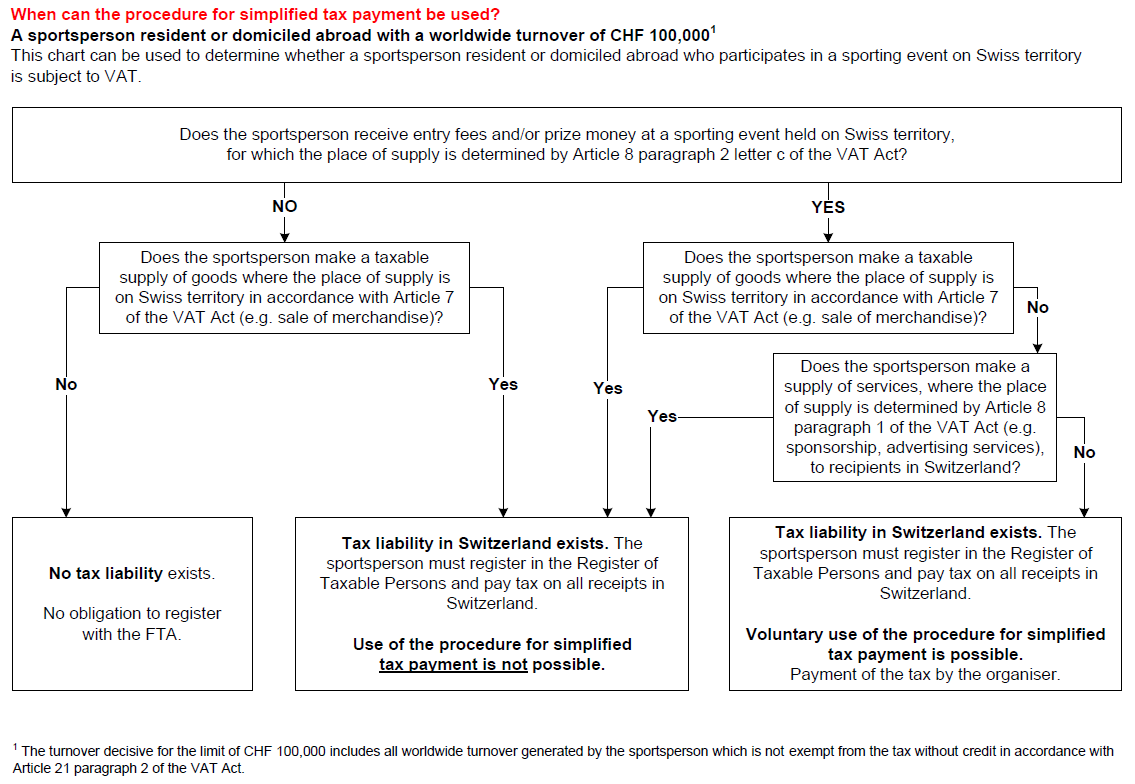

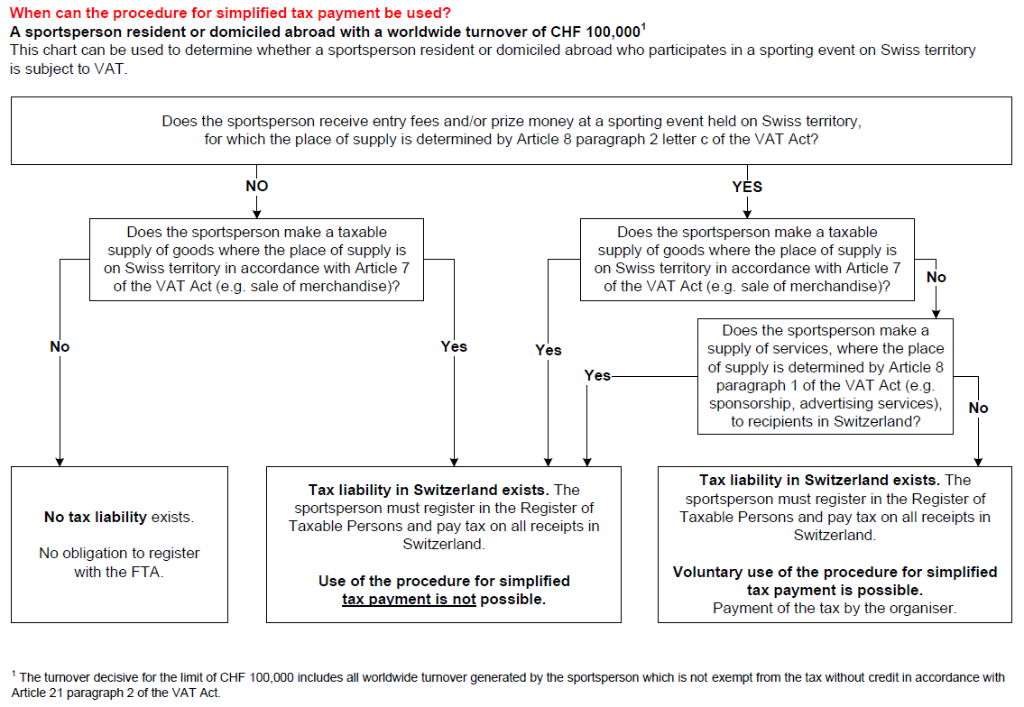

Sportspeople and sports teams resident or domiciled abroad may become liable for VAT in Switzerland.

Tax liability

Sportspeople and sports teams resident or domiciled abroad may become liable for VAT in Switzerland if they

- win prize money or receive an entry fee when participating in a domestic sporting event

- and at the same time achieve a turnover per year of at least CHF

100 000 worldwide. For non-profit, voluntarily-run sporting associations, the relevant turnover is CHF 250 000.

Sportspeople and sports teams

The information sheet for sportspeople (sportsmen and sportswomen) and sports teams resident or domiciled abroad concerning VAT in Switzerland provides information on their rights and obligations with regard to value added tax.

Organiser of international sporting events

The information sheet for organisers of international sporting events in Switzerland informs the organisers about the procedure for simplified tax payment.

Simplified tax payment procedure

Contact

Contact by phone (German)

Federal Tax Administration FTA

Main Division VAT

Legal Division

Schwarztorstrasse 50

3003 Berne

Last modification 15.01.2024

Contact

Contact by phone (German)

Federal Tax Administration FTA

Main Division VAT

Legal Division

Schwarztorstrasse 50

3003 Berne