This page is aimed at all taxpayers and tax authorities affected by the Spontaneous Exchange of Information on advance tax rulings.

Questions and answers about the Spontaneous Exchange of Information

General questions

As a member of the OECD, Switzerland has ratified the Convention on Mutual Assistance in Tax Matters, which came into force in Switzerland on 1 January 2017.

As a result, since 1 January 2018, the parties to the convention have exchanged any information that is foreseeably relevant for the administration or enforcement of their domestic laws concerning the taxes covered by the convention (Article 4 of the convention). Thus, Article 7 of the convention sets out the circumstances in which information can be exchanged spontaneously, i.e. without prior request.

Within the scope of the OECD and G20 project to combat base erosion and profit shifting (BEPS), the spontaneous exchange of information was specified for the first time in the area of advance tax rulings. These rulings are, where there is a risk of base erosion or profit sharing. Action 5 of the BEPS made the spontaneous exchange of information on rulings a minimum standard. The aim is to avoid harmful tax practices and create greater transparency through the exchange of rulings between the countries concerned. For this reason, Switzerland exchanges spontaneously generated summaries of the relevant rulings with the partner states to the convention.

The exchange of information upon request refers to the exchange of information between tax authorities further to a request for administrative assistance. The legal basis is provided by bilateral agreements (double taxation agreements; DTAs) and Article 5 of the Administrative Assistance Convention, in conjunction with Article 4 of the administrative assistance convention.

The spontaneous exchange of information takes place without prompting or prior request. Information is spontaneously exchanged between tax authorities when the transmitting state suspects that information may be of interest to another state. The legal basis is provided by Article 7 of the convention; the requirements in domestic procedures are defined in the Tax Administrative Assistance Act (Art. 22a of the TAAA) and the Tax Administrative Assistance Ordinance (Art. 5 et seq. of the TAAO).

As part of the automatic exchange of information, partner states regularly, and without prior request, provide each other with information on financial accounts, as well as country reports, for example. The procedure is based on the Federal Act on the International Automatic Exchange of Information in Tax Matters (AEOIA).

In accordance with Article 8 of the TAAO, an advance tax ruling is a notification, confirmation or assurance from a tax administration, which:

- has been given to a taxpayer;

- relates to the tax implications of information provided by the taxpayer; and

- can be relied upon by the taxpayer.

A spontaneous exchange of information on these tax rulings takes place in the cases set out in Article 9 of the TAAO.

If an exchangeable tax ruling is available, a spontaneous exchange of information must take place with the competent authorities in the country of residence of the directly controlling company and the main group entity (Art. 10 para. 1 of the TAAO). Other circumstances in which a spontaneous exchange must take place are set out in Article 10 paragraph 2 of the TAAO.

However, Switzerland exchanges tax rulings only with countries, which have also ratified the Administrative Assistance Convention. For this reason, at the moment (status as of May 2021), there is no spontaneous exchange of information with the US for example, because it has not yet ratified the Administrative Assistance Convention.

Switzerland has been spontaneously exchanging ruling information with partner states since 1 January 2018. However, the receipt of forms submitted by the partner states already began on 1 January 2017.

The spontaneous exchange of information concerns the information on tax rulings as defined in Articles 8 and 9 of the Ordinance on International Administrative Assistance in Tax Matters (StAhiV; SR 651.11 only available in German, Italian or French) and listed in Article 11, paragraphs 1, letters b to l, 2 and 3.

For more information, please consult:

- Article 7 of the Convention on Mutual Administrative Assistance in Tax Matters (MAC; SR 0.652.1);

- Articles 22a et seq. of the Federal Act on International Mutual Assistance in Tax Matters (StAhiG; SR 651.1);

- Articles 8 and 9 StAhiV.

Spontaneous exchanges are limited to the member states of the MAC. Exchanges between member states are based on reciprocity. Spontaneous transmissions by Switzerland have been taking place since 1 January 2018. However, the receipt of forms submitted by partner states already began on 1 January 2017.

The list of all member states and the respective date of entry into force for each state can be found in the MAC.

The contracting parties shall exchange any information that is foreseeably relevant for the administration and enforcement of their domestic law regarding the taxes covered by the MAC. From a Swiss perspective, a spontaneous exchange of information will take place regarding, among other things, income and wealth tax, including tax on profits, capital gains and capital. For further information, please refer to Article 2, sections 1 and 4, and Appendix A of the MAC.

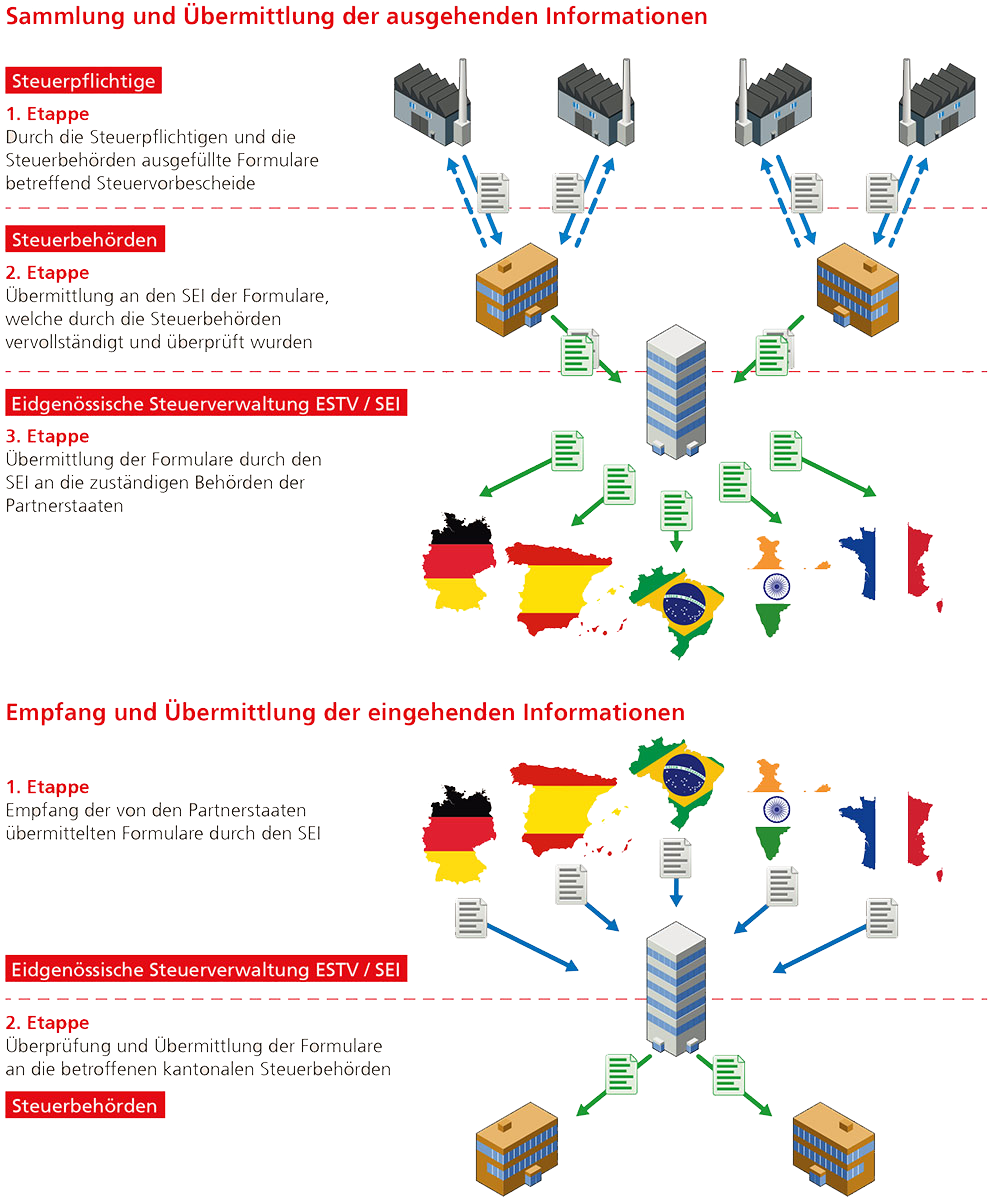

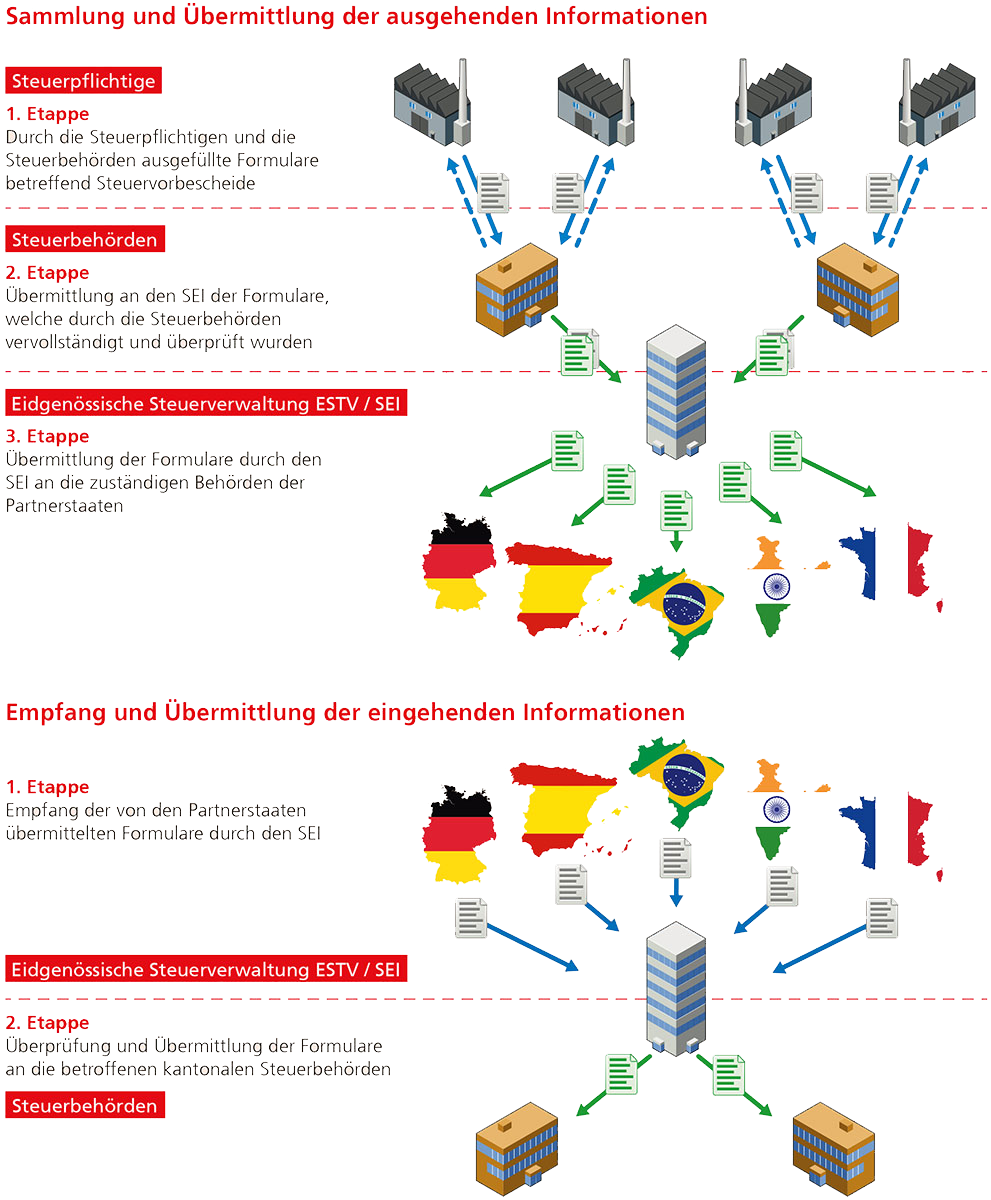

The tax authorities are required to collect the ‘rulings’ that they administer and that are subject to the spontaneous exchange of information. The information to be transmitted is listed in Article 11 of the StAhiV.

The FTA must transmit the information concerning rulings issued between 1 January 2010 and 31 December 2016 to the partner states within a twelve-month period from 1 January 2018.

If the information to be exchanged concerns a ruling that was issued after 1 January 2017, the FTA must forward it to the partner states within three months of receiving it.

Questions about the procedure

The information specified in Article 11 of the TAAO must be entered truthfully and in full in an online form on the information exchange platform and sent to the Division for Exchange of Information in Tax Matters (SEI).

The competent offices of the cantonal tax administrations and the FTA are obliged to provide the SEI with the spontaneously submitted information on an ongoing basis, but at the latest within 60 days after an advance tax ruling has been issued (see Art. 12 of the TAAO). The competent tax administration decides whether the taxpayers should fill in the online form, or whether it will do so itself.

Once the ruling has been recorded on the information exchange platform as part of a ruling notification (summary), the taxpayer concerned is informed of the planned spontaneous exchange of information (Art. 22b of the TAAA; Ensuring the right to a fair hearing). In this regard, the SEI sets a ten-day deadline for the person to consent to the information transfer or lodge any objections and/or view the files. If the person concerned consents within the deadline, the information is transferred to the states affected by the advance tax ruling and the procedure is closed without a conclusive decree being issued.

If the person concerned submits a statement, this is checked by the SEI after consultation with the competent cantonal tax administration and/or the FTA, and the notification is adjusted as appropriate before being transmitted. In such cases, the SEI contacts the person concerned once again to inform them of the planned transmission in accordance with Article 22b of the TAAA. At the same time, the person concerned is again requested to give their consent.

If the person concerned does not consent to the information being transmitted, the FTA (SEI) issues a conclusive decree under Article 17 of the TAAA. The issued conclusive decree can be challenged within 30 days by lodging an objection with the Federal Administrative Court (Art. 19 of the TAAA, in conjunction with Art. 44 et seq. of the APA, in conjunction with Art. 31 of the FACA).

As soon as a ruling notification is definitively entered on the information exchange platform, it can be modified only by the SEI. Under Article 22b of the TAAA, if the notification has not yet been sent abroad, modifications can be made. The changed circumstances/errors can be submitted to the SEI as objections within 10 days after receiving the notification.

If circumstances change, for example if other states are affected by a transaction after a notification has already been exchanged with the state concerned, a correction notice must be entered on the information exchange platform. The correction notice must be entered by the competent offices of the cantonal tax administrations and the FTA. The completed correction notice undergoes the same procedure as a new ruling notification before it is sent, appropriately labelled, to the partner states concerned.

Questions about the tax ruling

Even if an advance tax ruling existed only briefly, it can be relevant for the tax period concerned and thus meets the criteria set out in Article 8 of the TAAO. If it also falls into one of the categories in Article 9 of the TAAO, it is subject to the spontaneous exchange of information.

If the cancelled advance tax ruling subsequently turns out not to be relevant for the assessment, the information is either not transmitted or the transmitted information is corrected in accordance with Article 14 of the TAAO. A tax ruling that is cancelled shortly after being issued is not relevant for the assessment in particular in cases where the competent assessment authority would perform taxation even without having previously obtained an advance tax ruling (e.g. when granting holding status).

However, if the tax ruling applies an existing discretionary rule (e.g. setting of a price for transferring intellectual property rights) and taxation takes place despite the cancellation of the tax ruling, the tax ruling is to be regarded as relevant for the assessment and the transmitted information should therefore not be corrected.

As soon as a taxpayer is hypothetically able to rely on a tax ruling, a spontaneous exchange must take place (benchmark for fictitious protection of trust). The criterion for this is that the data to be transmitted is available (e.g. the group companies concerned or their countries of residence are already known). It is possible for a correction to be made subsequently in accordance with Article 14 of the TAAO.

Switzerland currently does not exchange ruling notices with the US, as the US has not yet ratified the administrative assistance convention (status: May 2021). Nonetheless, a tax ruling that is subject to the spontaneous exchange of information and involves the US in addition to other partner states must be entered on the information exchange platform. The same applies to tax rulings that involve only the US.

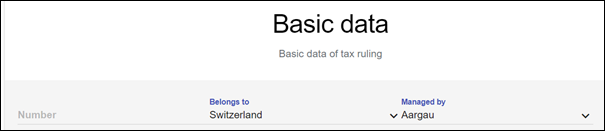

Such a tax ruling must be entered twice separately on the information exchange platform. In the basic data of the two ruling notices, the responsible canton must be selected in the "Belongs to" input field in one version and the FTA ("Switzerland") in the other version. For the latter, the input field "Managed by" is also displayed. There you have to select the authority to which the entered ruling notice should be sent (usually also "Switzerland", so that the notice will be sent to the FTA).

Questions about the ruling message & the specialist application (ePortal)

Ruling notices can be entered in the information exchange specialist application and sent directly to the cantonal tax administration. To obtain access to the information exchange specialist application and the corresponding taxpayer, a personal account must first be set up on ePortal; it should use two-factor authentication (link). An invitation code (link) can then be redeemed which provides access to the information exchange specialist application and the corresponding taxpayer. The "Information exchange" tile in ePortal is not visible until at least one invitation code has been successfully redeemed and the second login factor has been activated. For each account, as many invitation codes as desired can be redeemed, and thus as many taxpayers as needed can be administered in the information exchange specialist application.

A ruling notice can be entered in the information exchange specialist application by clicking the white plus symbol at the far right of the blue bar «Information on tax rulings».

Please close the application and log out of ePortal. Then delete your browser cache and try again; alternatively, try using another browser such as Chrome, Firefox or Edge.

If the problem persists, please contact the Help Desk by phone at +41 58 464 54 01 or by email to spontane.amtshilfe@estv.admin.ch.

When you log in to ePortal, click "Forgotten password?" and answer the security questions. If you cannot answer them correctly, you will have to re-register on ePortal with another email address. If you do not wish to use another email address, please contact the Help Desk by phone at +41 58 464 54 01.

Please request the invitation code directly from the cantonal tax administration of the taxpayer's canton of residence. If the tax ruling process has been completed with the FTA, please request the invitation code by phone at +41 58 484 90 73, or by email to ruling.dvs@estv.admin.ch. To obtain access to the information exchange specialist application, you can redeem your invitation code via the button "Redeem invitation code" (at top left). Please note that invitation codes are valid for only 30 days. Thereafter, the invitation code can no longer be used and you will have to request a new one.

The information exchange specialist application is integrated into ePortal and can only be accessed via the portal.

For security reasons, two-factor authentication must be activated in order to access the information exchange specialist application in ePortal.

Please log in to ePortal. In your profile settings at top right, you can enable and disable alerts.

The information exchange specialist application is integrated into ePortal, which has replaced myTaxWorld/PAMS.

Contact

Federal Tax Administration FTA

Division for exchange of information in tax matters

Eigerstrasse 65

3003 Berne

Last modification 11.12.2025